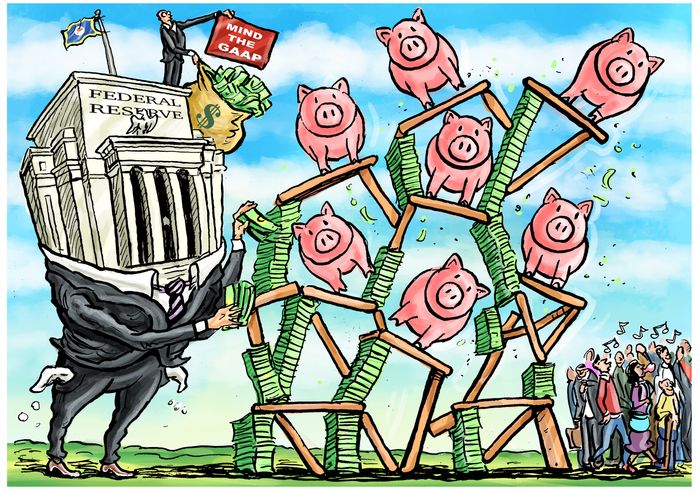

The New Bank Bailout

1 min read

An Opinion from the Wall Stree Journal

Taxpayers are bailing out Federal Reserve member banks—institutions that own the stock of the Fed’s 12 district banks—and hardly anyone has noticed. For more than 100 years, our central-banking system has made a profit and reliably remitted funds to the U.S. Treasury. Those days are gone. Sharp rate hikes have made the interest the Fed pays on its deposits and borrowing much higher than the yield it receives on its trillions in long-term investments. Since September 2022, its expenses have greatly exceeded its interest earnings. It has accumulated nearly $93 billion in cash operating losses and made no such remittances.

The Fed is able to assess member banks for these losses, but it has instead borrowed to fund them, shifting the bill to taxpayers by raising the consolidated federal debt. That tab is growing larger by the week. Under generally accepted accounting principles, the Fed has $86 billion in negative retained earnings, bringing its total capital to around negative $50 billion.